Navigating the Pre-Approval Process for Home Loans in Dubai

The thought of owning a home in Dubai is the best thing to work on. Since the concept of house loans seems intimidating at first, the reality is that you can structure your house-hunting experience by starting the journey with pre-approval and increasing the odds of getting a house loan in Dubai. Here is a comprehensive guide containing the critical steps to follow when you want to get pre-approval for house loans in Dubai.

- Introduction to Pre-Approval:

Pre-approval is an assessment process that lenders run to establish your ability to qualify for a loan. It differs from pre-qualification, which depends on the information you provide to the lender; pre-approval depends on facts following the lender’s verification. The house hunting process becomes more realistic from the onset, making you a potential buyer to any seller.

- Gather All Essential Documentation:

Make sure you have all the crucial fundamental documents before initiating the pre-approval application. Identification documents such as your passport or Emirates ID may be required. Also, you may need proof of income, such as sly slips, bank statements, or employment letters. Lastly, have proof of your assets, liabilities, and other accounts ready. Preparation of the documents before the pre-approval application enables the process to be done with ease without any inconveniences.

- Assess Your Financial Position:

Before going for pre-approval, one should reasonably assess the financial position. Sum the monthly earnings with all the bonuses and commissions paid. Next, the undischarged recurring expenses and financial debts should be subtracted. The user may refer to commercial and private loans with unpaid balances, credit card debts, and obligatory financial expenditures.

- Choose the Right Lender:

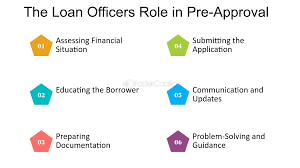

The second step in the process of acquiring pre-approval involves the selection of the right lender. It is vital to identify the best financial institutions in Dubai City that are active in the home loan sector. The user should carefully analyze the rates offered, terms, client service, and overall status among clients in the real estate market. After doing this, the user can approach several lenders to request pre-approval and choose the best offer based on the results.

- Submit Your Pre-Approval Application:

After compiling the necessary papers and selecting a lender, submit the pre-approval application. It is essential to ensure that the information provided is similar and that no itinerary copies are used to prolong the process.

- Await Pre-Approval Decision:

Once the pre-approval application is channeled, the lender will follow up with an all-encompassing evaluation of your financial state of affairs and credibility. The time frame of the process can stay put for a number of days up to a couple of weeks, depending on the lender’s inner workings procedures and prevailing work.

Conclusion

Knowing the basics and documentation requirements, revising financial logs to perceive yourself better, choosing the best lender, and submitting all parts of the pre-approval application is the fundamental future-situated tasks that will support your aspiration and boost your likelihood of being granted agreeable recognition. Top mortgage companies in Dubai can help you understand and follow the guidelines accordingly. Dubai’s unstable real estate industry has shaped many people, so study and understand your civil rights and legal authority.